Chapter 6. The cost of Capital. Every business enterprise has its own cost of capital. The cost of capital means the cost of funds gathered from different sources. Usually, the expected income of the finances is considered as the cost of the capital of the organization. A business enterprise collects its necessary funds from different sources. The costs of capital of different sources are not equal. So, the cost of capital of each of the sources needs to be calculated separately. In this chapter, we shall be able to know about the cost of capital, the importance of calculating the cost of capital, calculating the cost of capital of different sources of funds and other related things.

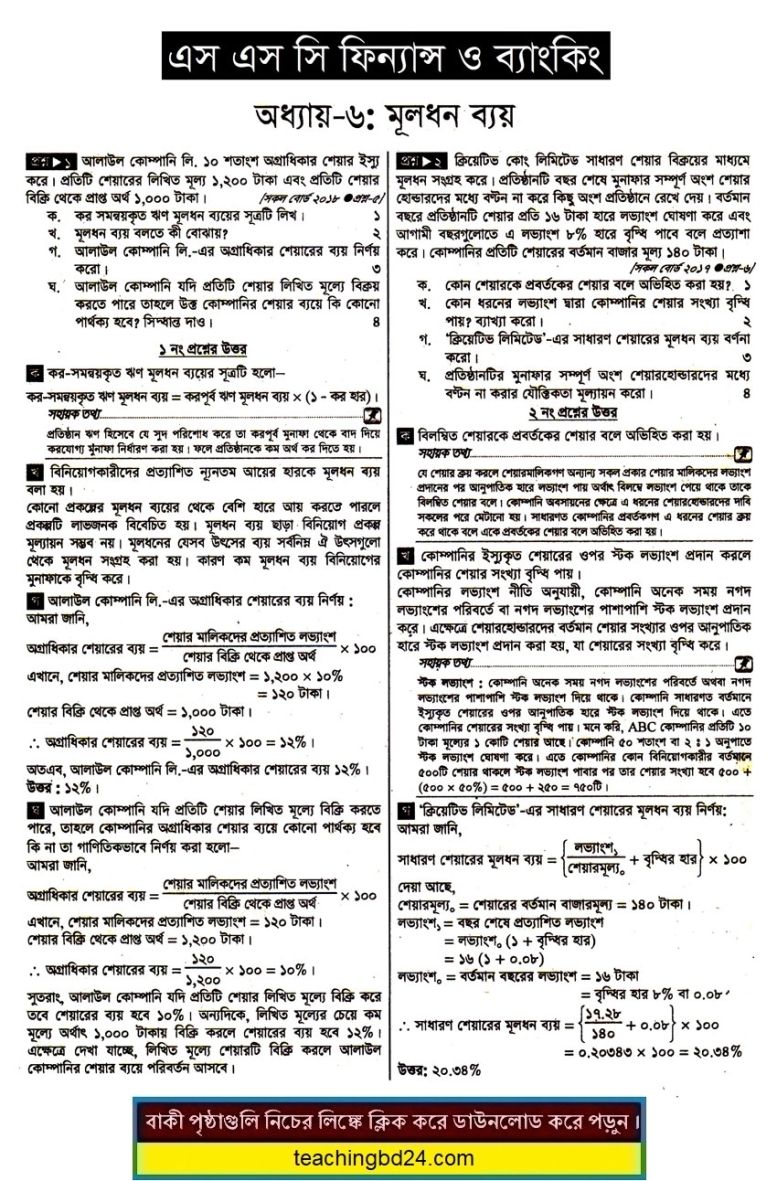

Chapter 6. The cost of Capital

After the investment decisions of the three friends mentioned in the previous chapter, such as, – Rahim’s buying a fridge, Karim’s buying a sewing machine and Sankar’s buying a wheelchair and a hair cutting machine – they have to finance these investments. You have learned that there are many sources of financing, like the – own capital of the owner, loan from friends, bank loan, the loan from other financing organizations, etc.

The cost of capital is the required return necessary to make a capital budgeting project, such as building a new factory, worthwhile. When analysts and investors discuss the cost of capital, they typically mean the weighted average of a firm’s cost of debt and cost of equity blended together.

The cost of the capital metric is used by companies internally to judge whether a capital project is worth the expenditure of resources, and by investors who use it to determine whether an investment is worth the risk compared to the return. The cost of capital depends on the mode of financing used. It refers to the cost of equity if the business is financed solely through equity, or to the cost of debt if it is financed solely through debt.

Many companies use a combination of debt and equity to finance their businesses and, for such companies, the overall cost of capital is derived from the weighted average cost of all capital sources, widely known as the weighted average cost of capital (WACC).

The cost of capital represents a hurdle rate that a company must overcome before it can generate value, and it is used extensively in the capital budgeting process to determine whether a company should proceed with a project.

The cost of the capital concept is also widely used in economics and accounting. Another way to describe the cost of capital is the opportunity cost of making an investment in a business. Wise company management will only invest in initiatives and projects that will provide returns that exceed the cost of their capital.

The cost of capital, from the perspective on an investor, is the return expected by whoever is providing the capital for a business. In other words, it is an assessment of the risk of a company’s equity. In doing this an investor may look at the volatility (beta) of a company’s financial results to determine whether a certain stock is too risky or would make a good investment.

teachingbd24.com is such a website where you would get all kinds of necessary information regarding educational notes, suggestions and questions’ patterns of school, college, and madrasahs. Particularly you will get here special notes of physics that will be immensely useful to both students and teachers. The builder of the website is Mr. Md. Shah Jamal Who has been serving for 30 years as an Asst. Professor of BAF Shaheen College. He expects that this website will meet up all the needs of Bengali version learners /students. He has requested concerned both students and teachers to spread this website home and abroad.

Discover more from Teaching BD

Subscribe to get the latest posts sent to your email.