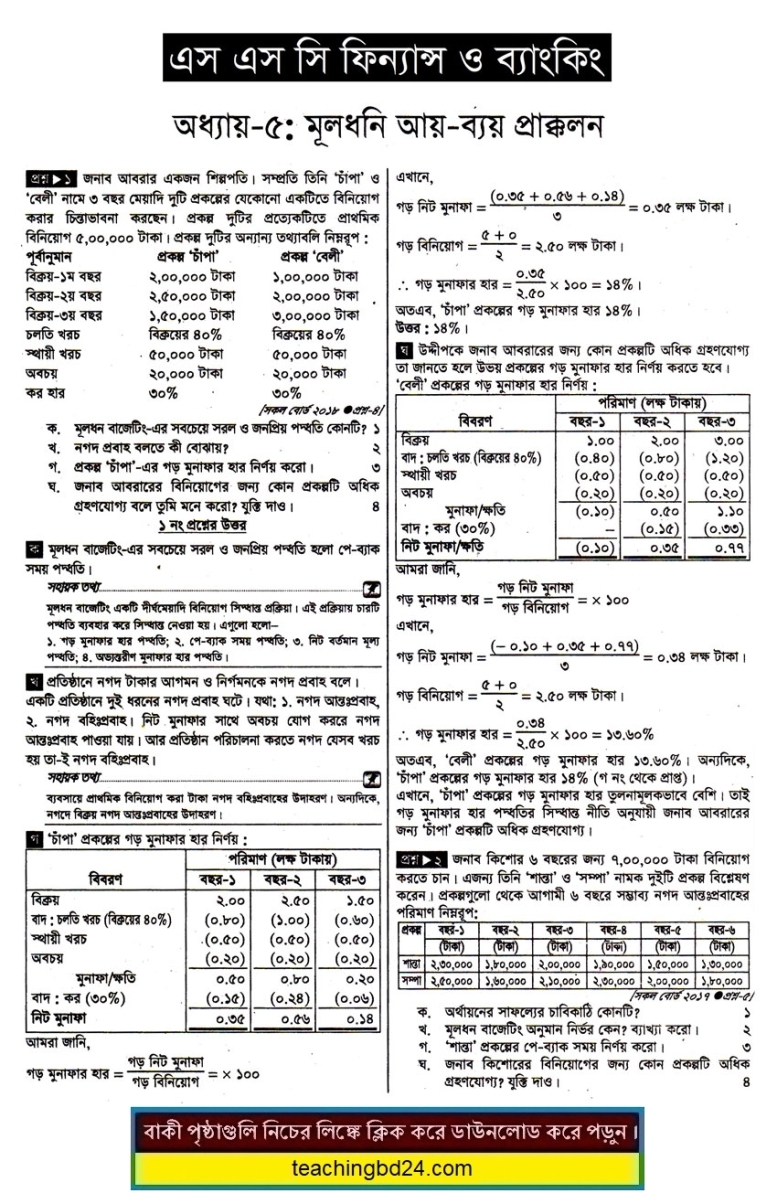

Chapter 5. Capital Budgeting

Chapter 5. Capital Budgeting. The success and existence of any business organization depend on the long-term investment decision. To run the business most of the time entrepreneur has to make different decisions regarding fixed asset like the purchase of land, building, furniture, equipment, etc., and replacement of this fixed asset, modernization of production process, development of new products. Whether these long term decisions will be profitable or not for the company? It requires the following different methods and principles for the proper evaluation of different alternative investment decisions. Throughout this chapter, we will be able to know about different financial methods, principles that are used in the evaluation process for taking the long term investment decision.

Chapter 5. Capital Budgeting

Three friends Rahim, Karim and Shankar run their individual business. Rahim has been thinking to purchase a fridge for his grocery shop for the last few days. Six months back, Karim started his tailoring business with a sewing machine. Guessing the increasing demand he thought to purchase a new machine. On the other side, to start a saloon Shankar is thinking to purchase some essential furniture and hair cutting machines. Here, fridge purchase of grocery shop, sewing machine purchase of tailoring shop and wheelchair, hair cutting machine purchase for saloon are all long-term investment decisions.

Main article: Equivalent annual cost

The equivalent annuity method expresses the NPV as an annualized cash flow by dividing it by the present value of the annuity factor. It is often used when assessing only the costs of specific projects that have the same cash inflows. In this form, it is known as the equivalent annual cost (EAC) method and is the cost per year of owning and operating an asset over its entire lifespan.

It is often used when comparing investment projects of unequal lifespans. For example, if project A has an expected lifetime of 7 years, and project B has an expected lifetime of 11 years it would be improper to simply compare the net present values (NPVs) of the two projects unless the projects could not be repeated.

The use of the EAC method implies that the project will be replaced by an identical project.

Alternatively, the chain method can be used with the NPV method under the assumption that the projects will be replaced with the same cash flows each time. To compare projects of unequal length, say 3 years and 4 years, the projects are chained together, i.e. four repetitions of the 3-year project are compared to three repetitions of the 4-year project. The chain method and the EAC method give mathematically equivalent answers.

The assumption of the same cash flows for each link in the chain is essentially an assumption of zero inflation, so a real interest rate rather than a nominal interest rate is commonly used in the calculations.

Real options analysis has become important since the 1970s as option pricing models have gotten more sophisticated. The discounted cash flow methods essentially value projects as if they were risky bonds, with the promised cash flows known. But managers will have many choices of how to increase future cash inflows or to decrease future cash outflows. In other words, managers get to manage the projects – not simply accept or reject them. Real options analysis tries to value the choices – the option value – that the managers will have in the future and adds these values to the NPV.

teachingbd24.com is such a website where you would get all kinds of necessary information regarding educational notes, suggestions and questions’ patterns of school, college, and madrasahs. Particularly you will get here special notes of physics that will be immensely useful to both students and teachers. The builder of the website is Mr. Md. Shah Jamal Who has been serving for 30 years as an Asst. Professor of BAF Shaheen College. He expects that this website will meet up all the needs of Bengali version learners /students. He has requested concerned both students and teachers to spread this website home and abroad.