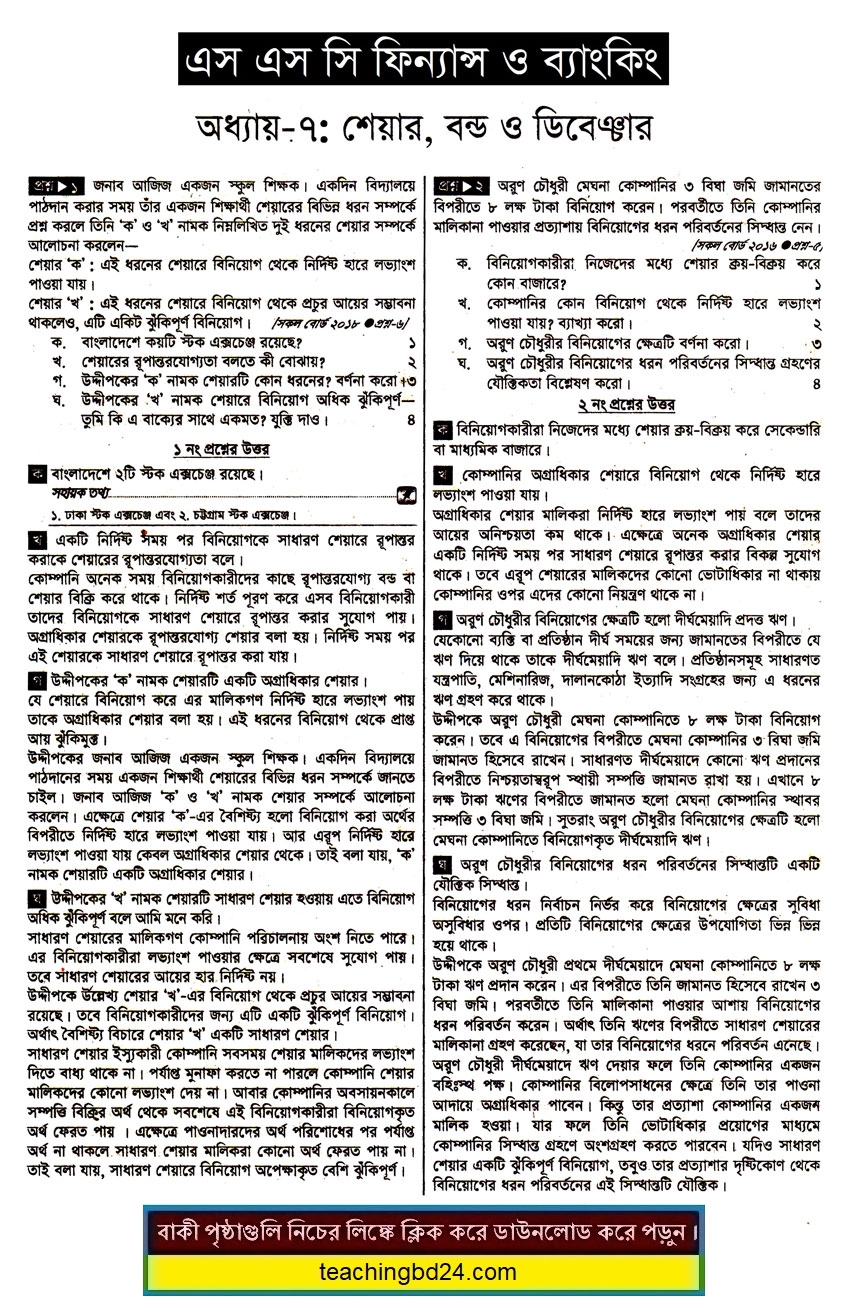

Chapter 7. Share, Bond and, Debenture

Chapter 7. Share, Bond and, Debenture. Share, Bond, and Debenture issued by companies are taken as different tools of investment for the investors. Each of these tools of investment used as sources of investment has its individual features, advantages, and disadvantages. The expected income and risks of the investors from these tools of investment are different. So, an investor should know about different sides of each of these tools of investment before making his decision for investment. In this chapter, we shall be able to know about these tools of investment from the perspectives of the investors.

Chapter 7. Share, Bond, and Debenture

In the previous chapters, you have known about general share, priority share, bond and debenture as sources of financing in business firms. These tools of financing issued by companies are considered as sources of investment for the investors. An investor can invest his money in different sectors. Assume, your father has 10 lac taka. He can, according to his wish, put it in a bank as a fixed deposit or he can invest it in one or more tools of investment – general share, priority share, bond and debenture issued by companies.

As sources of investment, each of these has its own special features. The expected income and risks of the investors from each of these tools of investment are different. Special features and advantages-disadvantages of each of these as the source of investment and their comparative evaluation have been discussed in the following paragraphs.

BONDS: It’s a financial instrument, which can be issued by companies, municipalities, states and sovereign governments, to raise funds from the market for the purpose of funding projects and activities. Individuals investing in bonds are called debt holders or creditors and they are entitled to get some fixed rate of interest on the principal amount. Some Bonds also trade like equities over the exchange, other trade over the counter (OTC).

Bonds are mostly issued to refinance some existing loans or finance some ongoing projects.

The interest which investors are entitled to from time to time are called c…(more)

Related QuestionsMore Answers Below

Difference between bond and equity?

What is the difference between share and equity?

What is meant by a debenture, share, equity, bond, derivatives?

Is there a difference between getting equity, stock, and shares? Is it better to get one over the other?

What is the difference between stock and shares?

Equity is typically referred to as shareholder equity (also known as shareholders’ equity) which represents the amount of money that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debt was paid off.

Shares are units of ownership interest in a corporation or financial asset that provide for an equal distribution in any profits, if any are declared, in the form of dividends. The two main types of shares are common shares and preferred shares. Physical paper stock certificates have been replaced with electronic recording of stock shares, just as mutual fund shares are recorded electronically.

Debentures are more secure than stocks, in the sense that you are guaranteed payments with high-interest rates. You are paid interest on the money you lend the company until the maturity period after which whatever you invested in the company is paid back to you. The interest is the profit you make from debentures. While stocks are for those who are willing to take risks for the sake of high returns, debentures are for people who want a safe and secure income.

Bonds are more secure than debentures. In the case of both, you are paid a guaranteed interest that does not change in value irrespective of the fortunes of the company. However, bonds are more secure than debentures but carry a lower interest rate. The company provides collateral for the loan. Moreover, in the case of liquidation, bondholders will be paid off before debenture holders.

teachingbd24.com is such a website where you would get all kinds of necessary information regarding educational notes, suggestions and questions’ patterns of school, college, and madrasahs. Particularly you will get here special notes of physics that will be immensely useful to both students and teachers. The builder of the website is Mr. Md. Shah Jamal Who has been serving for 30 years as an Asst. Professor of BAF Shaheen College. He expects that this website will meet up all the needs of Bengali version learners /students. He has requested concerned both students and teachers to spread this website home and abroad.