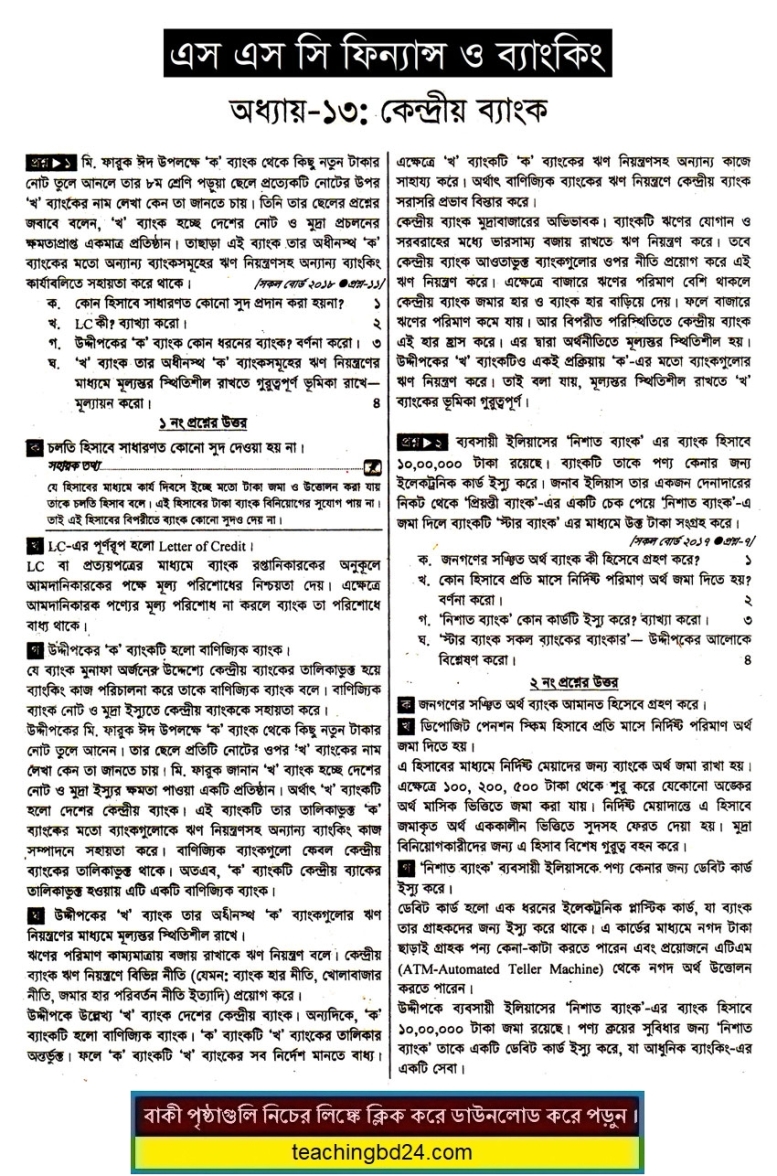

Chapter 13. Central Bank. By means of studying, this chapter students will be able to learn about the role of Central Bank as a guardian and its contribution to the economy, business, agriculture and industry and they can realize the relationship between Central Bank and Government. In this chapter, a concept also has given on the different levels of banking management and their responsibilities.

Chapter 13. Central Bank

It was the time of the 17th century, different kinds of banks were evolved in different regions; thus the money market controlling activity became the most important activity. From this realization, Central Bank was established. This bank couldn’t leave the money market in the own way rather it was liable to control the money market Mechanism. At the very beginning of civilization, Central Bank used to doing its responsibilities in currency circulation, money supply, and credit control. Different economist has given the definition of Central Bank in different ways.

By far the most visible and obvious power of many modern central banks is to influence market interest rates; contrary to popular belief, they rarely “set” rates to a fixed number. Although the mechanism differs from country to country, most use a similar mechanism based on a central bank’s ability to create as much fiat money as required.

The mechanism to move the market towards a ‘target rate’ (whichever specific rate is used) is generally to lend money or borrow money in theoretically unlimited quantities until the targeted market rate is sufficiently close to the target. Central banks may do so by lending money to and borrowing money from (taking deposits from) a limited number of qualified banks, or by purchasing and selling bonds.

As an example of how this functions, the Bank of Canada sets a target overnight rate and a band of plus or minus 0.25%. Qualified banks borrow from each other within this band, but never above or below, because the central bank will always lend to them at the top of the band, and take deposits at the bottom of the band; in principle, the capacity to borrow and lend at the extremes of the band are unlimited.[9] Other central banks use similar mechanisms.

The target rates are generally short-term rates. The actual rate that borrowers and lenders receive on the market will depend on (perceived) credit risk, maturity and other factors. For example, a central bank might set a target rate for overnight lending of 4.5%, but rates for (equivalent risk) five-year bonds might be 5%, 4.75%, or, in cases of inverted yield curves, even below the short-term rate. Many central banks have one primary “headline” rate that is quoted as the “central bank rate”. In practice, they will have other tools and rates that are used, but only one that is rigorously targeted and enforced.

“The rate at which the central bank lends money can indeed be chosen at will by the central bank; this is the rate that makes the financial headlines.” Henry C.K. Liu explains further that “the U.S. central-bank lending rate is known as the Fed funds rate. The Fed sets a target for the fed funds rate, which is Open Market Committee tries to match by lending or borrowing in the money market … a fiat money system set by command of the central bank.

teachingbd24.com is such a website where you would get all kinds of necessary information regarding educational notes, suggestions and questions’ patterns of school, college, and madrasahs. Particularly you will get here special notes of physics that will be immensely useful to both students and teachers. The builder of the website is Mr. Md. Shah Jamal Who has been serving for 30 years as an Asst. Professor of BAF Shaheen College. He expects that this website will meet up all the needs of Bengali version learners /students. He has requested concerned both students and teachers to spread this website home and abroad.

Discover more from Teaching BD

Subscribe to get the latest posts sent to your email.