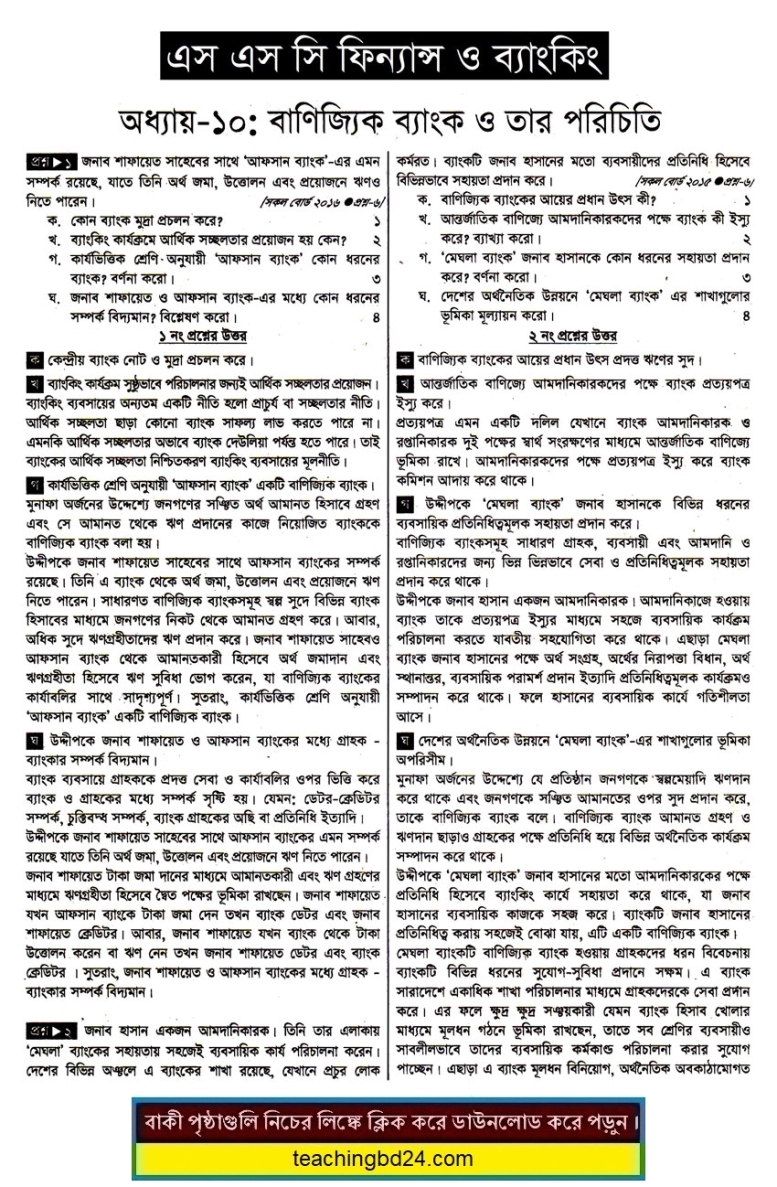

Chapter 10. Banking Business and Types. Students will have an idea about the formation of banks, their scopes, objectives, and management system from this chapter. A brief concept of different types of the banking system has been disseminated hereby classifying them. Besides, an idea of governmental and non-governmental banking management has also been given in a limited scope. This chapter will also be useful to have a primary concept of banking.

Chapter 10. Banking Business and Types

The size, structure, objectives, and formation of the banking system have changed a lot with the progress of time. Banking has passed through different phases of change namely traditional banking, modern banking and electronic banking. Besides, in a competitive market, innovative banking products and services are being provided to adapt to the need of the generation and clients.

Retail banks are the banks that the vast majority of people are familiar with. If you have a personal bank account, then your personal bank account will be held with a retail bank. If you have a credit card, have taken out a loan (including a mortgage), then you will have dealt with a retail bank.

Retail banking services are, traditionally, offered through bank branches on the High Street. You can obtain other banking services through these branches, but the bulk of the focus will on retail banking. However, this is often the area that makes the least amount of money for a bank. The bulk of a bank’s money will be derived from other banking aspects. One of the main reasons retail banking exists is to ensure that the bank has money ‘to hand’ which they are able to use to fund other banking ventures.

Business banking is much the same as retail banking, albeit offered specifically to companies. This means that business banking services will deal with business bank loans, business credit cards, etc.

When a company opts for business banking, the account will be opened up in the name of the business, often with specific people named on the account who will have access to the various business services.

Dependent on the business banking services that are required, the business may need to supply a business plan. This is incredibly important if the business is seeking a loan because the bank needs to know that they are going to get their money back.

Business banking is important for companies of all sizes. There will often be a fee attached for business banking, something which is not going to be there for retail banking. This may be a set fee for operating your bank account through the company, or there may be a transaction fee for everything that you do with the account. This is something that will be established by the bank when you open up your account.

To be honest, there is going to be a lot of overlap between business banking and corporate banking. In fact, for many banks, there will be little to no difference between the two. However, when the majority of people think of corporate banking, they think of investment and the like.

Many companies who wish to invest their earnings to increase them will deal with corporate banking. However, it is also a service used by those who are looking to sell shares in their company. For example; you will find that a lot of companies who are about to list themselves on the stock exchange will use corporate banking.

teachingbd24.com is such a website where you would get all kinds of necessary information regarding educational notes, suggestions and questions’ patterns of school, college, and madrasahs. Particularly you will get here special notes of physics that will be immensely useful to both students and teachers. The builder of the website is Mr. Md. Shah Jamal Who has been serving for 30 years as an Asst. Professor of BAF Shaheen College. He expects that this website will meet up all the needs of Bengali version learners /students. He has requested concerned both students and teachers to spread this website home and abroad.

Discover more from Teaching BD

Subscribe to get the latest posts sent to your email.